In our last Blog post we discussed Term insurance; what it is and when it is your best choice for insurance coverage. In this Blog post we will discuss permanent or cash value insurance, starting with Whole Life insurance. This will complete the two part article; Term Life Insurance vs. Cash Value Insurance.

When it comes to permanent or cash value insurance, Whole Life insurance is the plain vanilla choice. Please don’t misunderstand me, plain vanilla is not a bad thing. In fact, for many it is often the best choice.

As always, when considering purchasing insurance it is best to start by asking yourself the basic question; what am I insuring, for how long, and why? Write those reasons down and keep them with you as you research your policy choice. Doing so will keep you focused on your needs rather than being distracted by bells and whistles, unusable or unnecessary features and price.

We wrote last week that Term Insurance will insure against a premature death and, if you have a living benefit policy, insure against a living through a major medical event or long-term care need bankrupting your family. However, term insurance expires. In fact, according to the insurance industry statistics, 98% of all term insurance policies expire worthless. Whole life insurance insures against everything mentioned above and in the term insurance blog, plus much more. Also, whole life never expires unless you cancel your premium payments.

What is Whole Life Insurance?

Whole life insurance is a permanent insurance; which means it will continue to insure you for your life time as long as you pay the premium. The premium never increases and the benefit never decreases. Like all insurance policies, the best time to purchase whole life insurance is when you are young and healthy. Doing so will lock in a low insurance rate for your entire life. It will also allow the policy the time it needs to compound your cash value without taxation into a serious nest egg.

Whole life is also a cash value insurance. In addition to the death benefit paid to your heirs, the insurance policy will build a cash value that you can access without tax consequences, for any reason, while you are alive. The cash value has two different growth rates; a guaranteed rate of return and a potential rate of return. The guaranteed rate is the absolute minimum amount of percent growth that will you receive on an annual basis. While this may be only a few percentage points, if you purchase insurance when you are young it can compound to be a substantial amount of money available to you for anything you need. Unlike money in the stock market, your insurance savings never have a losing year. The cash value in whole life insurance has been used to fund a tax-free retirement, new homes, college education for children, to relieve financial stress during times of family crisis like unemployment or disability. The list of “why” is endless. For the person who was forward thinking enough to secure a whole life policy early in life, the nest egg they built can be accessed tax-free at any time.

Whole life is also a cash value insurance. In addition to the death benefit paid to your heirs, the insurance policy will build a cash value that you can access without tax consequences, for any reason, while you are alive. The cash value has two different growth rates; a guaranteed rate of return and a potential rate of return. The guaranteed rate is the absolute minimum amount of percent growth that will you receive on an annual basis. While this may be only a few percentage points, if you purchase insurance when you are young it can compound to be a substantial amount of money available to you for anything you need. Unlike money in the stock market, your insurance savings never have a losing year. The cash value in whole life insurance has been used to fund a tax-free retirement, new homes, college education for children, to relieve financial stress during times of family crisis like unemployment or disability. The list of “why” is endless. For the person who was forward thinking enough to secure a whole life policy early in life, the nest egg they built can be accessed tax-free at any time.

When we are asked ‘what do most people do? The answer is clear, although surprising to most. According to the insurance industry statistics, only 22% of life insurance sales are for Term insurance. The remaining 78% of all insurance sales are for permanent, cash value insurance like Whole Life. In fact, Whole life made up 35% of all life insurance sales in 2012. Fixed and Indexed Universal Life, another form of permanent cash value life insurance, made up 38% of all life insurance sales in 2012. The remaining 5% was in the form of a permanent insurance called Variable Universal Life, which typically carries stock market risk in both the growth of cash value and the insurance benefit. Because the vast majority of consumers purchase insurance to reduce risk, the Variable Universal Life insurance is simply not that popular in comparison to Whole Life and fixed Universal Life insurance.

Comparing Term Life Insurance vs. Whole Life Insurance

When we get back to the basic question you should be asking yourself when considering life insurance; “what am I insuring, for how long, and why?” comparing term vs. whole life insurance becomes easy. Remember, the basic purpose of life insurance is to transfer the financial risk of an unexpected event from you or your family to the deep pockets of a life insurance company, with their contractual obligation to pay from the face amount of the policy. In the case of cash value policies, the insurance company also offers a guaranteed percent return on your money regardless of the performance of the stock or bond market. With whole life insurance, the insurance company bears the performance risk of the cash value in your policy, not you. The opposite is true with your 401(k), where your investment performance is your risk and your responsibility.

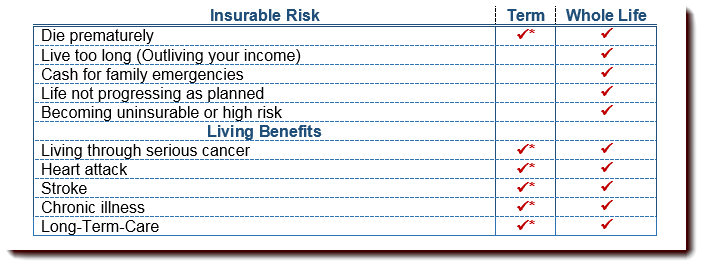

In the table below, the basic risks that can be transferred from you or your family to the life insurance company are listed comparing term and whole life.

*For a limited time. Once the Term expires all coverages ceases. 98% of all Term policies expire worthless.

Let’s go over each of these briefly to be certain we are communicated the concept properly.

Die prematurely; it is a fact of life that some of us will die at a young age, either from accidents, illness or other unexpected event. Both term and whole life policies insure against this possibility. The difference is that term insurance only insures until the insurance reaches its date of termination.

Live too long; with the poor performance of equity markets over the past fifteen years, the number one fear among those reaching retirement age is the fear of outliving their income. We have all heard stories of the elderly going back to work at Home Depot, the grocery store or McDonalds just to help pay bills. That is not how most of us want to live during retirement, but it can and is happening. Whole life insurance builds a guaranteed cash value with the risk of the return born by the insurance company, not the consumer. That cash can then be accessed tax free at any time, for any reason, including living a tax-free retirement.

Cash for emergencies & Life not progressing as planned; here, again, is the value of the guaranteed growth of cash value life  insurance. Unlike your 401(k), the cash equity in your Whole Life policy can be accessed at any time and for any reason. You access the funds by borrowing from yourself and paying yourself interest. You become your own banker. The cash you borrowed is yours to do as you wish, tax-free. At the same time, those borrowed funds are still technically in your policy and still grow in value as guaranteed by your policy. You can use the cash for family emergencies, to pay bills during a period of disability or unemployment, to pay for children’s college education or anything else you choose.

insurance. Unlike your 401(k), the cash equity in your Whole Life policy can be accessed at any time and for any reason. You access the funds by borrowing from yourself and paying yourself interest. You become your own banker. The cash you borrowed is yours to do as you wish, tax-free. At the same time, those borrowed funds are still technically in your policy and still grow in value as guaranteed by your policy. You can use the cash for family emergencies, to pay bills during a period of disability or unemployment, to pay for children’s college education or anything else you choose.

Sadly, many individuals are forced to cancel insurance policies when they are encumbered by hard times. Once they get back on their feet, they may find that if they can purchase life insurance, it will be much more expensive than what they owned before. Of course, the amount of cash you access is limited by what you the amount of cash you have in your policy.

Becoming uninsurable or a high risk; this is important and can best be illustrated by an example. Let’s say at 30-years of age you purchase a 30-year level term policy. This term policy will last until you are sixty, at which time it will either expire or the cost will increase to a level that is prohibitively expensive for most. At age 55 you developed a chronic illness, or cancer or some other major medical condition that renders you uninsurable or a high risk, and you live. Your term insurance is unaffected at that time. However, once you turn 60 your term insurance expires. Although your children now live on their own, your wife is still dependent on your income to some degree. In addition, the average cost of final expenses for a funeral and burial amount to more than $20,000, an amount more easily born via life insurance than your savings account. The bottom line, you still need some insurance. Unfortunately, you are not insurable and your life insurance just expired. Now you have no choices. Your wife must bear the financial risk when you die.

Becoming uninsurable or a high risk; this is important and can best be illustrated by an example. Let’s say at 30-years of age you purchase a 30-year level term policy. This term policy will last until you are sixty, at which time it will either expire or the cost will increase to a level that is prohibitively expensive for most. At age 55 you developed a chronic illness, or cancer or some other major medical condition that renders you uninsurable or a high risk, and you live. Your term insurance is unaffected at that time. However, once you turn 60 your term insurance expires. Although your children now live on their own, your wife is still dependent on your income to some degree. In addition, the average cost of final expenses for a funeral and burial amount to more than $20,000, an amount more easily born via life insurance than your savings account. The bottom line, you still need some insurance. Unfortunately, you are not insurable and your life insurance just expired. Now you have no choices. Your wife must bear the financial risk when you die.

With permanent insurance, like whole life, that risk is eliminated. You can keep your insurance until you stop paying your premium, and your premium will never increase. Thus, at age sixty you will still be paying the rate of a 30-year old and the insurance company will be obligated to bear the financial of your death. You may not be able to buy more insurance because of your medical history, but you do not face the risk of becoming uninsured.

Living benefits; thankfully, if you purchase the new type of life insurance, the type with living benefits, it won’t matter if you have term or whole life insurance, you will still be covered if a serious medical event places you in nursing or ling-term care, or renders you unable to perform all the activities of daily living. In these cases, you can access the death benefit of your life insurance policy while you are still alive. The most significant difference in this case is that term insurance and its benefits terminate on a specific date, whole life does not.

Shield Insurance Solutions is independent. Our goal is to find the best insurance company and policy for you. We specialize in living benefit life insurance and work with nearly 100 different insurance companies in order to find the right policy at the right value for you. We are transparent and have been in the financial services industry since 1984. Our life products include Whole Life, Universal Life and Term Insurance, mortage protection insurance and final expense insurance. As independent agents, we work hard to find the best life insurance company for you, with the best life insurance rates and value. We are based in Jupiter and Palm Beach Florida and licensed in almost every state. If you are shopping for a life insurance quote, we can show you what many of the top insurance companies will offer. The price differences will amaze you. Visit www.ShieldInsuranceSolutions.com to get a free life insurance quote comparison, or call us at (800) 847-9680.